What the Russian invasion of Ukraine could mean for global hunger

Russia’s invasion of Ukraine has destabilized European security and the global energy market — and now food could be next.

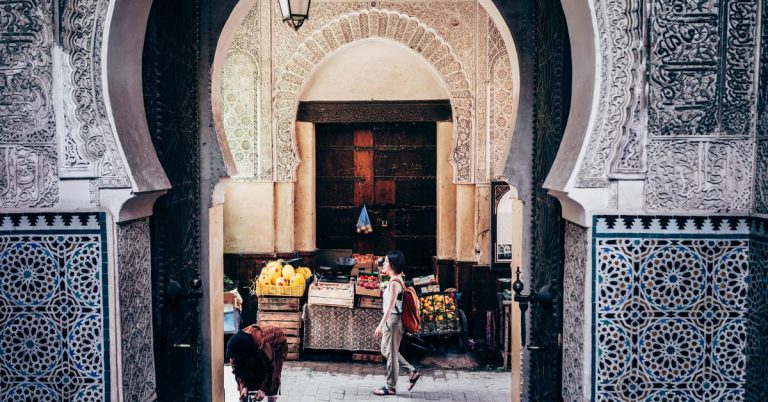

Dozens of countries across the Middle East, South Asia, and North Africa that already suffer from food insecurity rely on Russia’s and Ukraine’s bountiful supplies of wheat, corn, and vegetable oil, and experts say the conflict could send food prices rising and increase global hunger.

“It’s yet one more instance of conflict surfacing in the world at a time when the world just can’t sustain it,” said Steve Taravella, senior spokesperson at the World Food Programme (WFP) of the United Nations. “Hunger rates are rising significantly globally, and one of the largest drivers of hunger is manmade conflict.”

Even before the conflict, global food prices were already at their highest point since 2011, thanks to volatile climate conditions like droughts and overly heavy rainfall, as well as the broader supply chain disruptions created by Covid-19. With 855 million people already suffering from food insecurity, Russia’s invasion of Ukraine comes at an challenging moment for global hunger. The disruption in food production also puts Ukrainians — at least 100,000 of whom have already been displaced — at higher risk of hunger, underscoring the strong link between conflict and food insecurity.

What happens next depends on the progress of the war and the financial sanctions being put into place against Russia, and experts warn against predicting how exactly the conflict will affect global food prices and supplies. But given Russia’s and Ukraine’s enormous roles in providing food for the world — particularly wheat — instability in the region’s food production and exports could have consequences that will go well beyond the theater of war.

When farms become a battleground

To get a sense of just how critical Ukraine’s and Russia’s farmers are to the rest of the world, you have to understand just how much they export.

Ukraine and Russia are top exporters of major grains and vegetable oils, according to a Vox analysis of the food export data from International Trade Centre in 2020. The two countries account for the majority of the world’s sunflower-seed oil exports, while Russia is the world’s largest wheat exporter. Combined, Ukraine and Russia were responsible for about 26 percent of global wheat exports in 2020.

Wheat and corn prices were on the rise before the war. On February 24, when Russia invaded Ukraine, Chicago wheat futures spiked to their highest level since the beginning of the year. (They’ve since fallen — a partial sign of how much volatility war can inject into global food markets.)

Ukraine and Russia are important food suppliers for low- and middle-income countries in which tens of millions of people are already food insecure. Prices are further rising due to the conflict, and more increases as the war continues could cause greater food instability and hunger — not only in Ukraine, but around the world.

Egypt and Turkey rely on combined Russian/Ukrainian imports for 70 percent of their wheat supply, while 95 percent of Ukraine’s wheat exports went to Asia (including the Middle East) or Africa in 2020. In the Middle East and North Africa region, Yemen, Libya, and Lebanon rely on Ukraine for a high percentage of their wheat supply, while Egypt imports more than half its wheat from either Russia or Ukraine. Countries in South and Southeast Asia, such as Indonesia and Bangladesh, are also heavily reliant on wheat from the region. The largest importers of Ukrainian wheat in 2020 were Egypt, Turkey, Bangladesh, Indonesia, and Pakistan, while Russia is the source of a large percentage of wheat for many sub-Saharan African countries, including Nigeria and Sudan.

Disruptions in these exports will likely only increase the food insecurity already experienced by these countries. According to the WFP, nearly half of Yemen’s 30 million people get insufficient food. In Bangladesh, 29 million people get insufficient food, and over 30 percent of children under 5 are chronically malnourished. Indonesia and Egypt, respectively, are home to 26 million and 10 million people with insufficient food consumption, while over a quarter of Nigeria’s population — 55 million people, more than the entire population of Ukraine — have insufficient food consumption.

According to Alex Smith, a food and agriculture analyst at the tech-focused environmental think tank the Breakthrough Institute, rising wheat prices in countries with already high levels of food insecurity could be particularly devastating. In Yemen, where a long-running conflict was already worsening food insecurity, this is an “added bad element to an already bad scenario,” Smith said. In Libya, a supply disruption and higher prices would add to the existing food insecurity by limiting “the already food insecure people from getting the small amount of food they already are able to get and also puts more people into the category of food insecure,” he added.

Lebanon, whose wheat silos were destroyed two years ago in the Beirut port explosion and which relies on Ukraine for more than half its wheat, is already seeking alternative import deals, but hunger may increase anywhere that a government can’t afford to substitute wheat they were previously getting from Ukraine.

Russia is also the largest fertilizer exporter in the world, and pre-conflict fertilizer price spikes, according to Shirley Mustafa, an economist at the UN Food and Agriculture Organization (FAO), have already been contributing to the rise in food prices. Further disruption to fertilizer production or exports would damage agriculture in Europe, potentially contributing to even higher food prices around the world.

Ukrainian agriculture is more likely to be affected by direct conflict than Russia as farmers are pushed off their farms, while port closures are already limiting exports. “In two-three weeks farmers could start the planting season in Ukraine,” Iurii Mykhailov, a Kyiv resident, reported in Successful Farming. “But the Russian invasion changed everything. Because of military hostilities there are going to be big shortages of fuel and fertilizers. There certainly will be a lack of loans. There even may be a shortage of machine operators because of military losses, etc.”

Russian farmers are unlikely to be directly affected by conflict, said Smith, but the country’s exports could be affected in other ways. “The [region’s] major exporters — Ukraine, Russia, and Romania — ship grain from ports in the Black Sea, which could face disruptions from any possible military operation,” another WFP spokesperson told me on February 24; since then, Ukraine has already shut down ports and ships have been damaged by attacks.

“I think there’s less risk that sanctions will stop wheat exports from Russia,” Smith told me. “The real concern to me is actually whether Russia will choose to stop exports themselves in the case of sanctions or the conflict driving economic hardship for the Russian population, in which case Putin could just say we’re going to curb exports down as much as we can to keep prices of food low in Russia.”

This would not be unprecedented. Following the start of the Covid-19 pandemic in 2020, Russia temporarily halted grain exports for a few months, and the country stopped exports for almost a year in 2010 after a series of droughts and wildfires. That decision raised prices around the world — and not only among Russian grain importers.

How conflict raises the price of bread

Global food prices have been almost continuously rising since June 2020, said Mustafa, who works on the FAO Food Price Index, which measures monthly changes in international food prices of a basket of commodities. The FAO Food Price Index is now the highest it has been since 2011.

The rise has been due to a multitude of factors, including the weather anomalies created by the La Niña climate pattern, which has led to too little water in places like South America and too much in Southeast Asia. In the wheat sector, the US and Canada, two vital producers, were also hit by drought. Covid-19 has also continued to be a factor on both the supply and demand sides.

Conflict has historically been a driver of food price hikes. Researchers reported in a study that looked at 113 African markets between 1997-2010 that “feedback exists between food price and political violence: higher food prices increase conflict within markets, and conflict increases food price.” Other researchers have shown that the rise in food insecurity beginning in 2014 across sub-Saharan Africa was attributable to violent conflict, which increased in relative importance compared to drought from 2009-2018. A feedback cycle exists as well: Food price increases driven by war contribute to further conflict even in places that weren’t involved in the original war themselves.

Mustafa told me the effects of disruption depend on where the crop supply is concentrated. For example, if there’s a high level of export concentration, other countries are not able to compensate for the disruption, but if there are lots of exporters, other countries could make up the difference. “It also depends on the type of disruption you see — the length of it, the duration. If it’s relatively short-term, markets could potentially adapt rather quickly. If it’s a little bit of a longer-term disruption concentrated in just a few players, then you could potentially also see the disruption stimulate production elsewhere to compensate.”

A hungrier world is a less stable one

In a worst-case scenario, the disruption to commodity prices could also contribute to conflict beyond Ukraine’s borders in countries that heavily rely on its producers for grain. Not only does conflict cause higher food prices; higher food prices can contribute to conflict even in areas of the world that are not directly affected by the original event. Researchers Jasmien de Winne and Gert Peersman found that increases in food prices due to harvest shocks outside of African countries heighten violence within them.

“Although most violence does probably not occur because of higher food prices, but are caused by broader economic conditions or political grievances,” the authors write, “these income shocks can be a trigger to engage in violent events.”

Mustafa said that while the FAO was monitoring the situation, the agency could not give predictions on the specific crisis given the uncertainties in the situation. Taravella similarly said the WFP was in “watch and see mode,” and is ready to provide emergency assistance as soon as feasible.

The reality is that hunger almost always follows conflict. And when that conflict occurs in a major agricultural exporter like Ukraine and involves another like Russia, the victims could ultimately go far beyond the two countries at war.